Reasons for Startup Failures

Startup failures can occur due to various factors, and understanding these reasons can provide valuable insights for aspiring entrepreneurs. Here are some of the most common reasons why startups fail:

Lack of Market Need

The lack of market need is often cited as the primary reason for startup failures, accounting for 42% of failures in 2022 (CNBC). Startups may develop products or services that do not address a significant problem or fulfill a genuine need in the market. Without a strong market demand, startups struggle to attract customers and generate revenue, ultimately leading to failure.

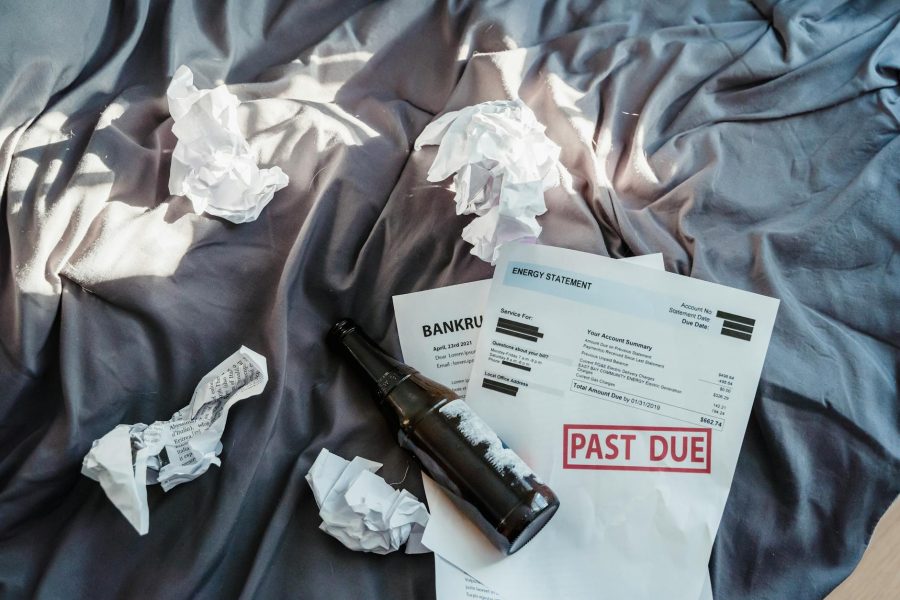

Running Out of Cash

Running out of cash is another critical factor that contributes to the failure of startups. In 2022, it was responsible for the failure of 29% of startups. Startups require sufficient financial resources to sustain their operations, invest in growth, and weather unforeseen challenges. Insufficient funding, poor financial management, or an inability to secure additional funding can lead to cash flow problems and ultimately force a startup to shut down.

Issues with the Team

The success of a startup heavily relies on the capabilities and cohesion of its team. Issues with the team accounted for 23% of failed startups in 2022 (CNBC). Problems such as disharmony among team members, lack of expertise, unbalanced skill sets, or poor leadership can hinder a startup’s ability to execute its plans effectively and adapt to changing circumstances. Building a strong, competent, and cohesive team is crucial for sustaining and growing a startup.

Competition from Existing Businesses

Competition from existing businesses poses a significant challenge for startups, contributing to the failure of 19% of startups in 2022. Established companies with established customer bases, resources, and brand recognition can often outmaneuver startups, making it difficult for them to gain market share. Startups need to differentiate themselves, identify a unique value proposition, and develop strategies to compete effectively in their respective industries.

Pricing and Cost Issues

Pricing products or services correctly is critical for startups. The inability to do so was a reason for failure in 18% of startups in 2022. Pricing products too high can alienate potential customers, while pricing them too low can lead to unsustainable profit margins. Startups need to conduct thorough market research, understand the value they provide, and develop pricing strategies that align with customer expectations and business goals.

Poor Marketing Efforts

Effective marketing plays a crucial role in attracting customers and generating revenue for startups. However, 13% of startups failed in 2022 due to poor marketing efforts (CNBC). Startups may struggle to reach their target audience, communicate their value proposition effectively, or differentiate themselves from competitors. Investing in strategic marketing initiatives, understanding customer needs and preferences, and adopting innovative marketing techniques can help startups increase their visibility and achieve sustainable growth.

By understanding the common reasons for startup failures, entrepreneurs can proactively address these challenges and increase their chances of success. It is crucial to conduct thorough market research, build a strong team, manage finances effectively, differentiate from competitors, set appropriate pricing strategies, and invest in impactful marketing efforts to navigate the risks and uncertainties of the startup journey.

Notable Failed Startups

Throughout the history of startups, there have been numerous instances of businesses that didn’t achieve the success they envisioned. Here are some notable failed startups that faced various challenges and ultimately had to shut down.

Color

In 2011, the photography app Color raised a substantial $41 million in funding before it even launched. However, despite the initial hype, the app failed to gain traction and was shut down within a year (Investopedia).

Fab

Fab, an image-sharing social media platform, attracted significant attention and raised approximately $330 million in funding in 2012. However, the company struggled to generate revenue at a pace that would justify its high valuation, leading to its eventual closure (Investopedia).

Better Place

Despite raising an impressive $850 million in financing, the shared office space provider Better Place went bankrupt in 2013. The company’s inability to translate its funding into sustainable business operations led to its downfall.

SpoonRocket

SpoonRocket, an on-demand food delivery startup, managed to secure $13.5 million in venture capital. However, intense competition within the food delivery industry ultimately led to the company’s failure.

WorldSpace

WorldSpace, a satellite radio company, raised nearly $2 billion in funding but filed for bankruptcy in 2008. Despite its significant financial backing, the company faced challenges that prevented it from achieving long-term success.

Airlift

Airlift, once one of Pakistan’s most highly valued and funded startups, shut down in July due to a lack of capital and an unsuccessful attempt to close a funding round. Despite raising $85 million in the country’s largest Series B funding, the company could not sustain its operations.

Argo AI

Despite having the support of Volkswagen and Ford and raising $1 billion in funding, Argo AI announced in October that it was shutting down. The company failed to attract new investors and secure additional funds, leading to its closure (TechCrunch).

Fast

Fast, a startup that provided online checkout products, announced its shutdown in early April. The company faced challenges with modest revenue growth in 2021 and high cash burn, despite raising $124.5 million in three years.

FTX

FTX, once the third-largest cryptocurrency exchange, filed for bankruptcy in the U.S. on November 11. The company’s CEO resigned, and legal troubles ensued. Despite raising nearly $2 billion in funding, FTX experienced significant difficulties (TechCrunch).

Haus

Haus, a direct-to-consumer aperitif business backed by prominent investors, shut down after crossing $10 million in revenue and securing national distribution. The closure resulted from an investor backing out of a committed funding deal, highlighting the challenges faced by venture-backed companies.

These are just a few examples of startups that encountered significant obstacles and were unable to sustain their operations. The failure of these startups highlights the risks and challenges inherent in the startup ecosystem. However, failure can also provide valuable lessons and insights for future entrepreneurs and investors.

Impact of Startup Failure

When a startup fails, the consequences can be significant and far-reaching. The impact of a failed startup can affect various stakeholders, including founders, employees, investors, and even the industry as a whole. Let’s explore the different aspects of the impact of startup failure.

Consequences for Founders

For founders, the consequences of a failed VC-backed startup can be devastating. Not only do they face the loss of their business, but they may also experience financial loss from personal investments and the lack of a salary. The emotional toll can be substantial, leading to feelings of guilt, shame, depression, and anxiety. The personal and professional setbacks may require founders to reassess their career paths and financial security.

Impact on Employees

The impact of a failed VC-backed startup on employees can be equally challenging. Job loss is a primary concern, leaving employees in search of new employment opportunities. The experience gained at the failed startup may not be easily transferrable to other companies, causing difficulties in their job search. Emotionally, employees may feel a sense of failure and doubt their abilities, requiring support and reassurance as they navigate their career paths (FasterCapital).

Impact on Investors

Investors also bear the brunt of a failed VC-backed startup. Financially, they face the loss of their investment and potential returns. Moreover, the reputational damage associated with a failed investment can impact their standing within the industry. The failure may lead to a decline in investor confidence, making it more challenging to secure future investments. Additionally, investors may have to consider the impact of the failure on the employees of the startup they invested in.

Effects on the Industry

The failure of a VC-backed startup can have broader implications for the industry as a whole. It may lead to a decrease in overall investment, as investors become more cautious due to the failed venture. The loss of investor confidence can have a ripple effect, making it harder for other startups in the industry to secure funding. The failure may also result in a negative perception of similar startups, making it more challenging for them to gain traction. Overall, the industry may experience a slowdown as a result of the failed startup.

Understanding the impact of startup failure is crucial for founders, employees, investors, and the industry at large. By acknowledging these potential consequences, stakeholders can better prepare themselves and navigate the challenges that arise from a failed venture.